Unleashing the Power of Trend-Following: Your Guide to Rules-Based Money Management – Part 8

Rules-Based Money Management: Putting Trend Following to Work

Trend following is an investment strategy that has gained significant popularity in recent years. By identifying and profiting from the momentum of market trends, trend following aims to capture profits in both up and down markets. This rules-based approach to money management can be a powerful tool for investors seeking to maximize their returns while managing risk effectively.

One of the key principles of trend following is the concept of riding the trend. This involves identifying a trend in the market, whether it be upward or downward, and then following that trend until it reverses. By doing so, investors can capture the majority of the trend’s profits while minimizing losses during market corrections.

In order to implement a successful trend following strategy, investors must first establish a set of rules to guide their decision-making process. These rules can include criteria for identifying trends, determining entry and exit points, and managing risk. By following these rules consistently, investors can avoid emotional decision-making and stick to a disciplined approach to investing.

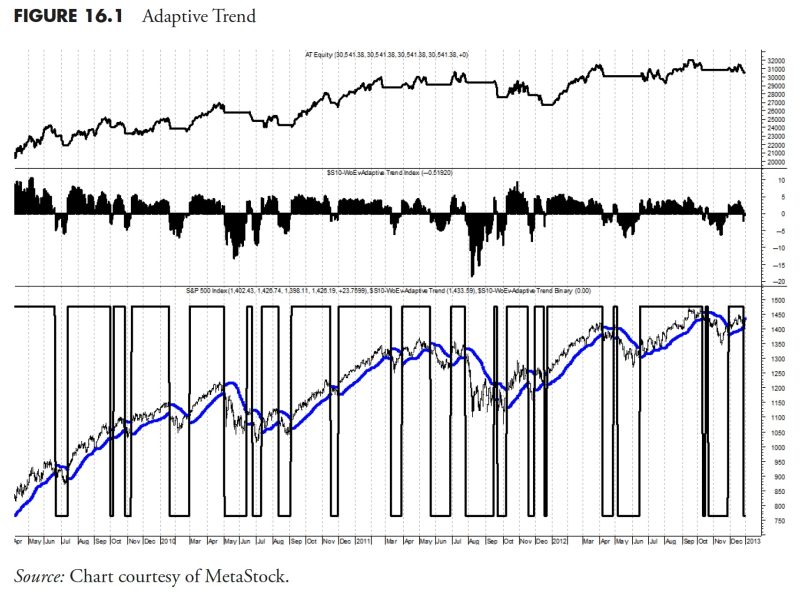

A crucial aspect of trend following is the use of technical analysis to identify trends and confirm their strength. Common technical indicators used in trend following include moving averages, relative strength index (RSI), and moving average convergence divergence (MACD). By using these tools, investors can better assess the direction and momentum of market trends and make informed trading decisions.

Furthermore, risk management is a cornerstone of successful trend following. By implementing proper risk controls, investors can protect their capital and avoid large losses during volatile market conditions. This can include setting stop-loss orders, diversifying across different asset classes, and adjusting position sizes based on market conditions.

Another important element of trend following is the need for patience and discipline. Trends can take time to develop and may experience periods of consolidation or reversals along the way. By staying committed to the strategy and not getting swayed by short-term market fluctuations, investors can maximize their chances of capturing profits over the long term.

In conclusion, trend following offers a systematic and rules-based approach to money management that can help investors navigate volatile market conditions and achieve consistent returns. By following a disciplined strategy, using technical analysis, implementing proper risk management, and maintaining patience and discipline, investors can effectively put trend following to work in their investment portfolios and capitalize on market trends.