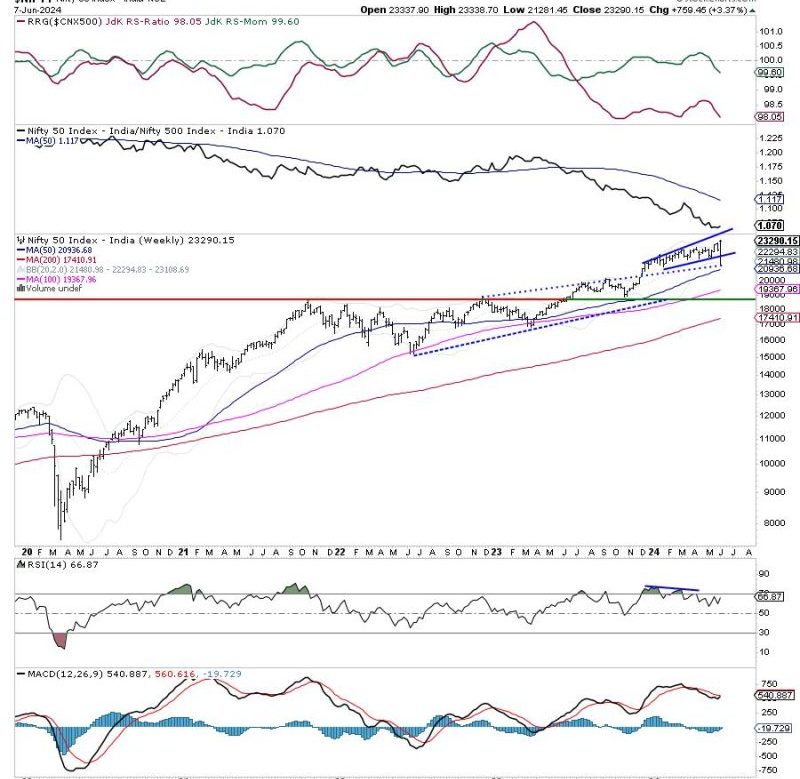

Anticipating the Week Ahead: Watch Out for Market Breadth and Nifty Retracement Trends

In the world of finance, market breadth is a crucial indicator that helps investors gauge the overall health of a market. Despite the recent pullback in the markets, the breadth remains a concern for many analysts. The Nifty index, which is a key benchmark in the Indian stock market, continues to be prone to retracement, raising uncertainties among investors.

Market breadth refers to the number of individual stocks that are advancing versus declining within a particular market index. A strong market breadth indicates that a large number of stocks are participating in the market rally, which is generally seen as a positive sign for the overall market sentiment. Conversely, a weak market breadth suggests that only a few stocks are driving the market higher, which can be a warning sign of a potential market reversal.

In the case of the Nifty index, the recent pullback has highlighted some weaknesses in market breadth. While the index itself may be showing resilience, the underlying breadth of the market is not as strong. This disparity can create a sense of fragility in the market, as it suggests that the rally is not being supported by a broad base of stocks.

One of the key concerns with a weak market breadth is that it can make the market more vulnerable to retracement. When only a handful of stocks are driving the market higher, any negative news or developments related to those stocks can have a disproportionate impact on the overall index. This can lead to sharp pullbacks or corrections, as seen in recent market movements.

To mitigate the risks associated with weak market breadth, investors can adopt a more cautious and selective approach to their investment strategies. By focusing on fundamentally strong companies with solid growth prospects and sound financials, investors can reduce their exposure to the inherent uncertainties created by a narrow market rally.

In conclusion, while the recent pullback in the markets may have raised concerns about market breadth, investors can navigate these challenges by staying vigilant and adopting a prudent investment approach. By monitoring market breadth indicators and focusing on quality stocks, investors can position themselves to withstand potential retracements and navigate the market with confidence.