Unveiling the Winning Strategies: How Past Patterns Uncover Pre-Earnings Moves!

In the realm of stock market investing, determining pre-earnings moves can offer valuable insights for traders and investors. Analyzing historical data can provide a glimpse into potential market trends and help individuals make more informed decisions. By understanding the patterns that have occurred in the past, market participants can better anticipate how a stock may behave leading up to an earnings release.

One of the key factors to consider when predicting pre-earnings moves is the stock’s past performance around earnings announcements. Research shows that certain stocks tend to exhibit consistent patterns in the days or weeks leading up to their earnings reports. By studying these patterns over time, investors can identify trends that may repeat themselves in the future.

Additionally, market sentiment and analyst expectations can play a significant role in shaping pre-earnings moves. If there is widespread optimism or pessimism surrounding a particular stock, it can influence how the stock price behaves ahead of an earnings release. Analyst reports and news articles can provide valuable insights into market sentiment and help investors gauge the potential direction of a stock.

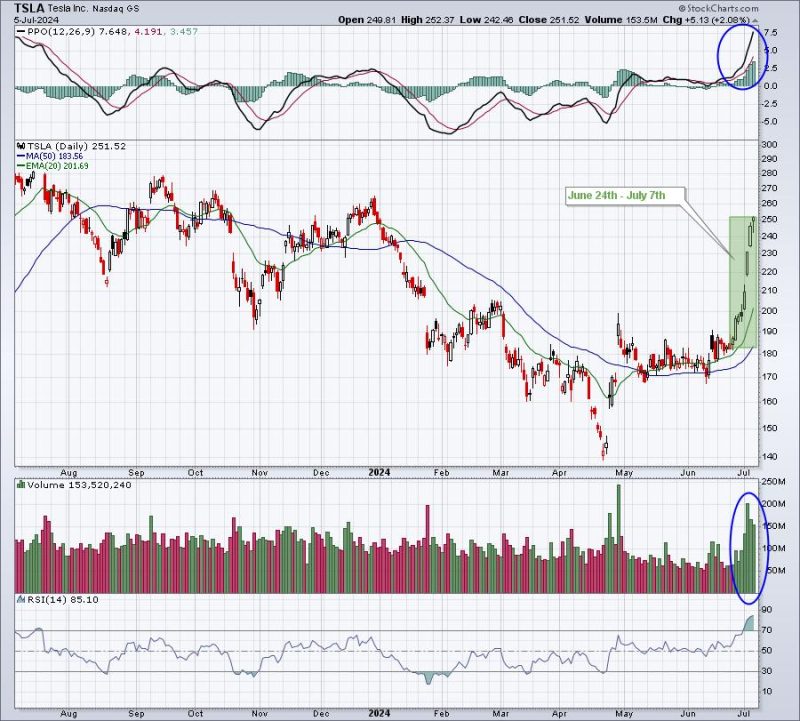

Technical analysis is another tool that can be utilized to forecast pre-earnings moves. By examining key indicators such as moving averages, support and resistance levels, and trading volume, investors can identify patterns that signal potential price movements before an earnings announcement. Chart patterns can also offer valuable clues about the stock’s likely trajectory leading up to earnings.

Moreover, industry trends and macroeconomic factors can impact pre-earnings moves. Stocks within the same sector may move in tandem based on broader industry dynamics or economic conditions. Understanding these external influences can provide a more comprehensive picture of how a stock may perform prior to an earnings release.

In conclusion, analyzing historical data, market sentiment, technical indicators, and external factors can help investors anticipate pre-earnings moves with greater accuracy. By leveraging these insights, market participants can make more informed trading decisions and position themselves to capitalize on potential opportunities in the stock market.