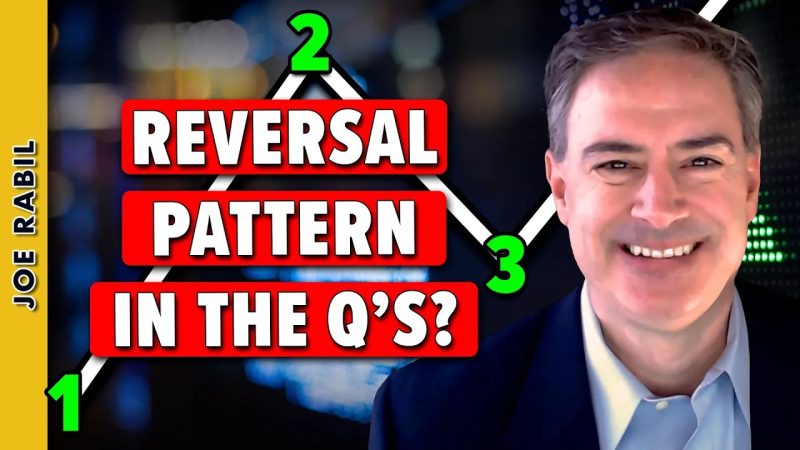

The 1-2-3 Reversal Pattern: A Comprehensive Guide

Understanding the 1-2-3 reversal pattern is crucial for traders seeking to maximize their profits in the financial markets. This pattern, also known as the 1-2-3 trend reversal setup, is a technical analysis tool used to identify potential trend reversals. By recognizing this pattern early on, traders can anticipate market shifts and make informed trading decisions.

The 1-2-3 reversal pattern consists of three key components: the initial trend, the reversal, and the confirmation. The first phase, the initial trend, is characterized by a prevailing market direction, either bullish or bearish. In this phase, traders are looking for a well-defined trend that has been established over a period of time.

The second phase, the reversal, occurs when the market shows signs of changing direction. This phase is marked by a significant price movement against the initial trend. For example, if the market has been trending upwards, the reversal phase would involve a sudden and sharp decline in prices. Traders use this phase to identify potential entry points for their trades.

The final phase of the 1-2-3 reversal pattern is the confirmation stage. During this phase, traders are looking for further confirmation that the trend has indeed reversed. This can come in the form of price consolidation, a break of key support or resistance levels, or a change in market momentum. Traders can use various technical indicators and tools to validate the reversal and make more accurate trading decisions.

To effectively use the 1-2-3 reversal pattern, traders should pay close attention to key levels of support and resistance, as well as price action and volume trends. By combining these elements with the three phases of the pattern, traders can increase the accuracy of their predictions and improve their overall trading performance.

In conclusion, the 1-2-3 reversal pattern is a powerful tool for traders looking to identify trend reversals and make profitable trades in the financial markets. By understanding the components of the pattern and using appropriate technical analysis techniques, traders can gain a competitive edge and enhance their trading success.