The Federal Reserve: A Puppet Master or a Nightmare Creator?

The Federal Reserve, often referred to simply as the Fed, is the central banking system of the United States. Established in 1913, its primary responsibilities include conducting monetary policy, supervising and regulating banks, and stabilizing the financial system. Over the years, the Fed has played a crucial role in shaping the economic landscape of the United States and influencing global markets. However, recent events have raised questions about the Fed’s true intentions and the impact of its policies on the economy.

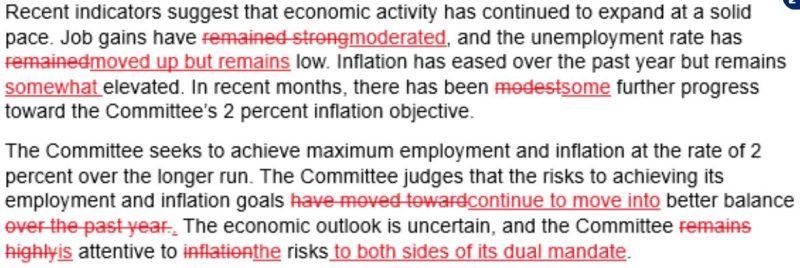

One of the key functions of the Fed is to control monetary policy through the manipulation of interest rates and the money supply. By adjusting these levers, the Fed aims to achieve its dual mandate of maximum employment and stable prices. In recent years, the Fed has resorted to unconventional monetary policies, such as quantitative easing, to stimulate the economy in times of crisis. While these measures have been effective in averting financial collapse, they have also raised concerns about the Fed’s increasing intervention in the market and its potential long-term consequences.

Critics of the Fed argue that its policies have distorted market signals, artificially inflated asset prices, and encouraged excessive risk-taking by investors. By keeping interest rates low for an extended period, the Fed has incentivized borrowing and speculation, leading to asset bubbles in housing, stocks, and bonds. Moreover, the Fed’s massive bond-buying programs have flooded the financial system with liquidity, potentially fueling inflation and distorting the allocation of capital.

Another contentious issue is the Fed’s close relationship with Wall Street and big banks. Critics allege that the Fed’s actions often prioritize the interests of financial institutions over those of the broader economy. The revolving door between the Fed and the financial industry has raised concerns about regulatory capture and conflicts of interest. The perception of a cozy relationship between the Fed and Wall Street has eroded public trust in the central bank and fueled suspicions of favoritism and cronyism.

Moreover, the Fed’s expanding balance sheet and growing influence over financial markets have raised questions about its accountability and independence. As the largest player in the bond market, the Fed has become a dominant force in setting interest rates and influencing asset prices. This concentration of power in the hands of unelected officials has prompted calls for greater transparency, oversight, and accountability of the Fed’s operations.

In conclusion, the Federal Reserve’s role as a central bank is essential for maintaining financial stability and promoting economic growth. However, the Fed’s increasingly interventionist policies and close ties to Wall Street have raised concerns about its independence, accountability, and effectiveness. As the Fed continues to navigate the challenges of a rapidly changing economic landscape, it must strike a balance between its mandate to support the economy and the risks of unintended consequences from its actions. Only time will tell whether the Fed is truly a puppet master pulling the strings of the economy or a nightmare creator sowing the seeds of its own destruction.