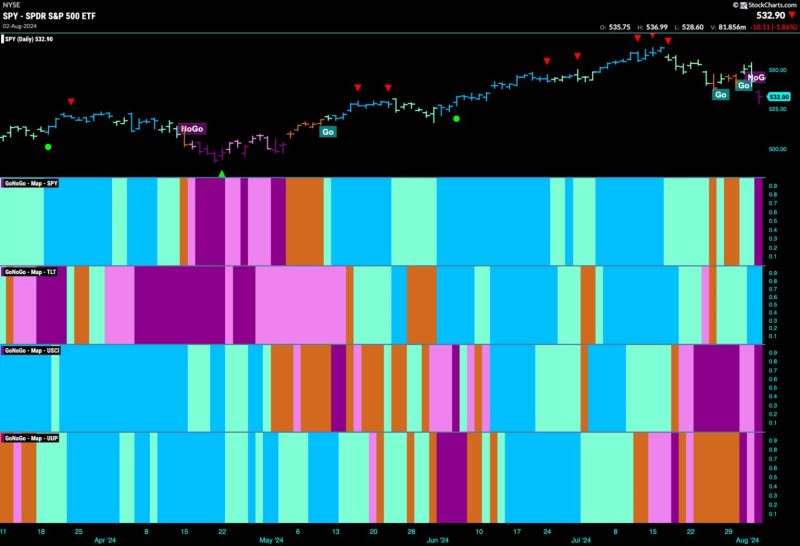

Stocks Get Defensive as Market Index Enters NoGo

The recent performance of the market index has pushed investors to adopt a defensive strategy, reconsidering their portfolio allocations and seeking refuge in safer investment options. This shift in investor sentiment towards a more defensive approach reflects the current uncertainties and risks present in the market.

One key factor driving this defensive stance is the growing concerns over global economic conditions. With escalating trade tensions between major economies and geopolitical uncertainties in various regions, investors are becoming increasingly cautious about the potential impact of these factors on corporate earnings and economic growth.

Furthermore, the recent inversion of the yield curve has raised red flags for many investors. Historically, an inverted yield curve has been a reliable indicator of an impending economic downturn. As a result, investors are bracing themselves for a possible recession and are adjusting their portfolios accordingly.

In response to these challenges, investors are shifting their focus towards defensive sectors such as utilities, consumer staples, and healthcare. These sectors are known for their resilience during economic downturns, as they provide essential goods and services that are less affected by cyclical fluctuations.

Additionally, investors are favoring dividend-paying stocks, which offer a steady income stream regardless of market conditions. By investing in companies with a history of stable dividends, investors can potentially mitigate the impact of market volatility on their portfolios.

Another defensive strategy gaining popularity among investors is increasing exposure to gold and other precious metals. These safe-haven assets tend to perform well during times of economic uncertainty, providing a hedge against inflation and currency devaluation.

In conclusion, the shift towards a defensive investment strategy reflects the current market environment characterized by economic uncertainties and growing risks. By reallocating their portfolios towards defensive sectors, dividend-paying stocks, and safe-haven assets, investors aim to protect their investments and navigate through turbulent market conditions with greater resilience and stability.