Get Ready: NIFTY Trends Cautiously Amid Defensive Strategy Shifts; Master These Key Levels

The market sentiment continued to sway as the Nifty index remained cautious amidst the development of a defensive setup. Investors are advised to be mindful of key levels to navigate through the uncertainty in the upcoming week.

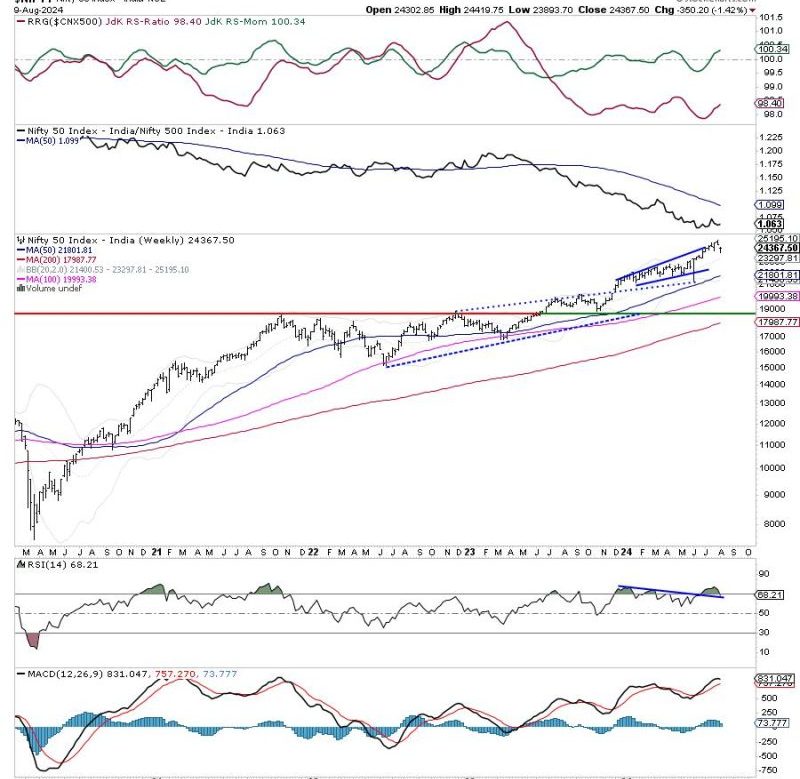

Technical analysis suggests that the Nifty could face resistance at the 16,500 level, with a support level around 16,130. This range is crucial for traders to monitor and base their decisions on.

Furthermore, moving averages such as the 50-day and 200-day can serve as important indicators for potential trend direction. If the Nifty manages to break above the 50-day moving average, it may signal a bullish trend. Conversely, a break below the 200-day moving average could indicate a bearish trend.

In terms of sector performances, defensive sectors like IT and pharmaceuticals have shown resilience in the recent market volatility. Investors might consider hedging their portfolios by allocating some exposure to these sectors to balance risk.

Amidst the cautious market atmosphere, it’s essential for traders to exercise patience and diligence in their decisions. The market could be swayed by external factors such as global cues, economic data releases, and geopolitical tensions. Staying informed and adapting to changing market conditions will be key to navigating the upcoming week successfully.

In summary, while the Nifty remains tentative with a defensive setup developing, traders should pay close attention to key levels, moving averages, and sector performances to make informed decisions. By staying alert and adapting to changing market dynamics, investors can position themselves strategically in the week ahead.