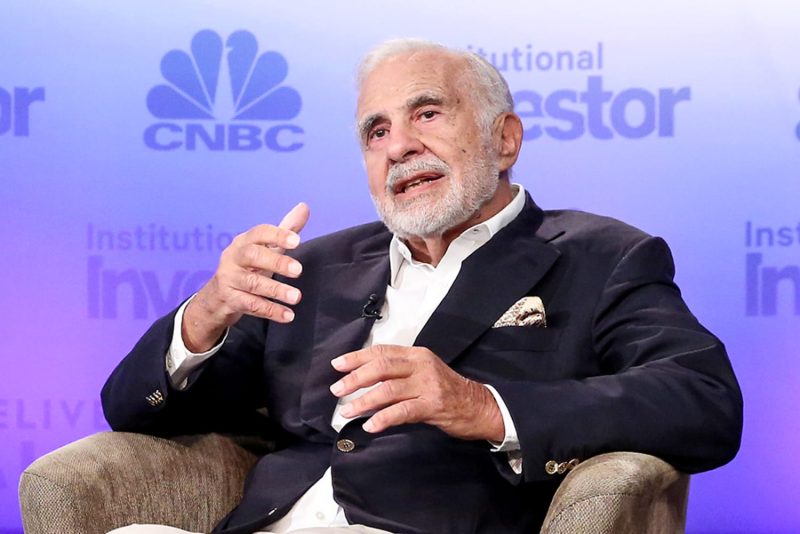

Carl Icahn Faces SEC Allegations of Concealing Billions in Stock Pledges

In a shocking turn of events, the Securities and Exchange Commission (SEC) has filed charges against renowned billionaire investor Carl Icahn for allegedly hiding billions of dollars worth of stock pledges. This revelation has sent ripples through the financial world, raising questions about transparency and accountability in high-stakes investing.

The SEC’s investigation into Carl Icahn’s dealings has unveiled a complex web of undisclosed stock pledges that were allegedly used as collateral for personal debts. This practice, known as pledging, involves using company shares as security for personal loans. While not illegal per se, failing to disclose these pledges can be seen as a violation of securities laws, particularly in cases where the size and significance of the pledges are substantial.

Icahn, known for his aggressive investing style and controversial corporate battles, has been a titan in the financial world for decades. His investment decisions have often had far-reaching impacts on industries and markets. However, the allegations of hiding stock pledges have cast a shadow over his otherwise illustrious career.

The SEC’s charges against Icahn signal a broader crackdown on financial transparency and integrity in the investing world. The case serves as a reminder that even the most powerful figures in finance are not above the law. The SEC’s enforcement actions aim to maintain a level playing field for all investors and uphold the integrity of the financial markets.

The revelation of Icahn’s undisclosed stock pledges raises concerns about the risks and consequences of such practices. Pledging shares as collateral can amplify financial leverage and expose investors to potential margin calls and forced liquidations in times of market volatility. Moreover, the lack of transparency around these pledges can obscure investors’ true exposure to risk, creating uncertainties and distortions in the market.

The case against Carl Icahn underscores the importance of full and timely disclosure in the financial world. Transparency is a cornerstone of investor confidence and market integrity. Investors rely on accurate and complete information to make informed decisions and assess the risks associated with their investments. Failing to disclose material information, such as stock pledges, undermines this trust and erodes the foundations of a fair and efficient market.

As the SEC moves forward with its charges against Carl Icahn, the case will likely draw significant attention from investors, regulators, and the public. The outcome of this legal battle could have far-reaching implications for the future of financial transparency and accountability. Regardless of the final verdict, the case serves as a cautionary tale for investors and market participants about the importance of honesty, disclosure, and integrity in the world of high finance.