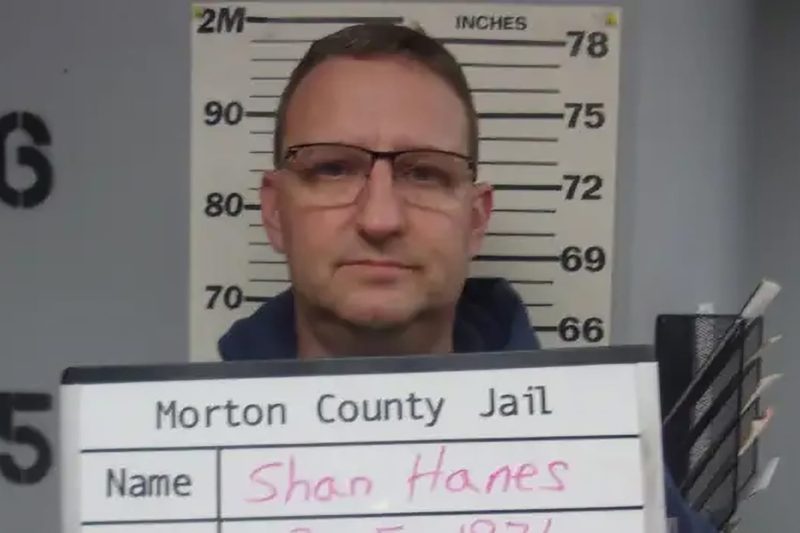

Pig Butchering Cryptocurrency Con: Ex-CEO of Kansas Bank Jailed for 24 Years

In a bizarre turn of events, a cryptocurrency pig-butchering scam has wreaked havoc on a small Kansas bank, ultimately resulting in the sentencing of the former CEO to 24 years in prison. This shocking case serves as a stark reminder of the risks and complexities associated with the emerging world of digital currencies and the potential for malicious actors to exploit unsuspecting victims.

The elaborate scheme, which unfolded over several months, involved the creation of a fictitious cryptocurrency named PorkCoin that purported to be backed by actual pig meat reserves held by the bank. Investors were lured in by promises of high returns and the illusion of legitimacy presented by the bank’s involvement in the project.

However, as the web of deceit began to unravel, it became clear that there were no actual pig meat reserves, and the funds deposited by investors were being siphoned off for personal gain by the orchestrators of the scam. The former CEO, who was at the center of the scheme, used his position of authority to perpetrate the fraud and cover up the burgeoning financial discrepancies.

As the investigation unfolded, it became apparent that the true extent of the damage caused by the cryptocurrency pig-butchering scam was far-reaching. Many investors, enticed by the promise of quick profits and the veneer of legitimacy provided by the bank’s involvement, had poured significant sums of money into the fraudulent scheme, only to be left with empty promises and depleted bank accounts.

The fallout from the scandal was severe, with the bank facing financial ruin and the former CEO facing a lengthy prison sentence for his role in perpetrating the fraud. The case serves as a cautionary tale for both investors and financial institutions, highlighting the importance of due diligence, regulatory oversight, and skepticism when dealing with the often opaque and volatile world of cryptocurrencies.

In conclusion, the cryptocurrency pig-butchering scam that wrecked a Kansas bank and sent its ex-CEO to prison for 24 years stands as a stark reminder of the potential dangers and pitfalls associated with emerging technologies and the need for robust safeguards to protect against fraud and deception in the digital age. It is a sobering reminder that the allure of quick riches can sometimes lead individuals and institutions down a perilous path, with devastating consequences for all involved.