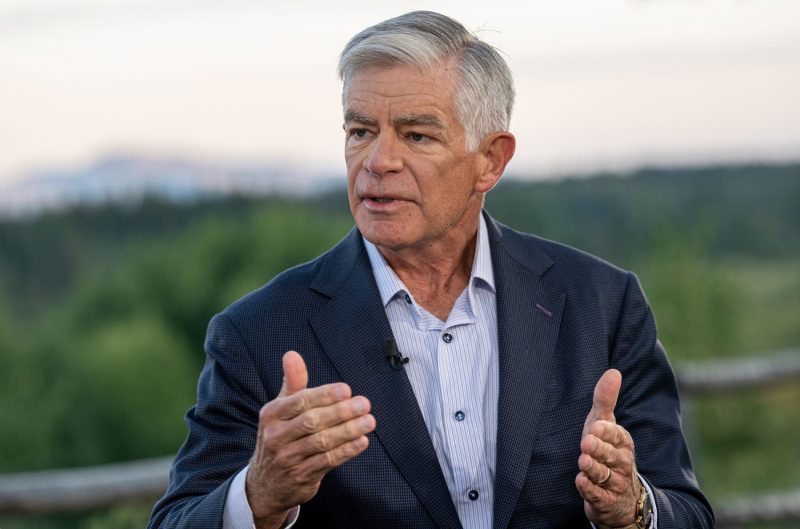

In a recent speech at the Geneva Graduate Institute, Philadelphia Fed President Patrick Harker made a strong case for a much-needed interest rate cut in September. Harker emphasized the importance of maintaining economic growth in the face of global uncertainties and slowing growth indicators.

The Fed President highlighted that while the current economic outlook is generally positive, there are several concerns that warrant a cautious approach. One of the key factors influencing his advocacy for an interest rate cut is the ongoing trade tensions between the U.S. and China. The uncertainty surrounding trade negotiations has already had a noticeable impact on business sentiment and investment decisions, and further escalation could significantly dampen economic growth.

Moreover, Harker pointed to recent data indicating a slowdown in manufacturing activity and weakening global demand. These trends, combined with the inverted yield curve – often seen as a precursor to a recession – underscore the need for proactive measures to support the economy.

Harker acknowledged that the U.S. labor market remains strong, with low unemployment rates and steady job growth. However, he cautioned that weak global demand and trade uncertainty could eventually spill over into the domestic economy, leading to a potential slowdown in job creation.

The Fed President’s call for an interest rate cut resonates with market expectations and reflects the growing consensus among policymakers that preemptive action is necessary to sustain economic expansion. By lowering interest rates, the Fed aims to stimulate spending and investment, providing a buffer against external headwinds and bolstering confidence in the economy.

In conclusion, Patrick Harker’s advocacy for an interest rate cut in September is a prudent response to the current economic challenges facing the U.S. While uncertainties loom large, decisive action by the Fed can help mitigate risks and support continued growth. As policymakers convene for the upcoming Federal Open Market Committee meeting, Harker’s arguments are likely to be at the forefront of discussions, shaping the trajectory of monetary policy in the months ahead.