Upcoming Week: NIFTY Holds Strong Uptrend with Defensive RRG Setup

The article discusses the current market trends and outlook for the Nifty index, as analyzed through RRG (Relative Rotation Graphs). The main points covered include the technical analysis of the Nifty index, the performance of various sectors, and the potential signals for investors.

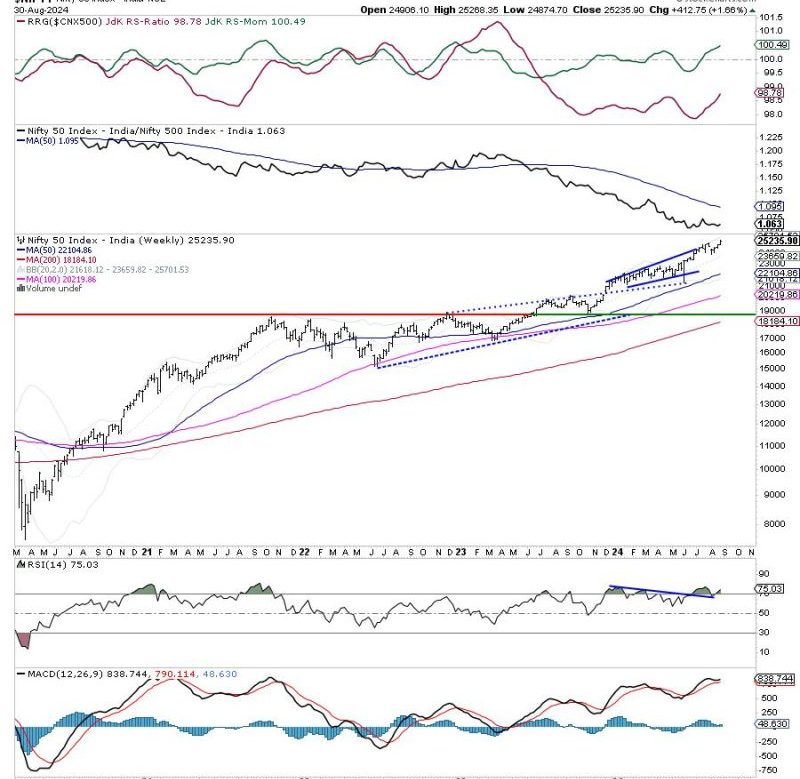

Technical analysis of the Nifty index indicates that the uptrend is still intact despite some consolidation around the resistance level. The formation of higher tops and bottoms over the past few weeks supports the bullish outlook, suggesting that the index may continue its upward movement in the short term.

RRG analysis provides further insights into sector performance and rotation patterns. The defensive sectors, including IT, FMCG, and Healthcare, are showing strength and resilience, with a distinct defensive setup on the RRG. This indicates that investors have been rotating their funds into these defensive sectors, seeking stability and safety amid market uncertainties.

On the other hand, the banking and realty sectors show a weakening trend on the RRG, suggesting that investors may be less confident in these sectors. The relative underperformance of these sectors could be a signal of potential risks for investors, and they may need to reassess their investment strategies accordingly.

Overall, the combination of technical analysis and RRG insights paints a comprehensive picture of the market dynamics and provides valuable information for investors to make informed decisions. While the uptrend in the Nifty index remains intact, investors should pay attention to sector rotation patterns and adjust their portfolios accordingly to navigate potential market challenges and opportunities.