Maximizing Your Portfolio Amidst a Stock Market Sell-Off: A Strategy Guide

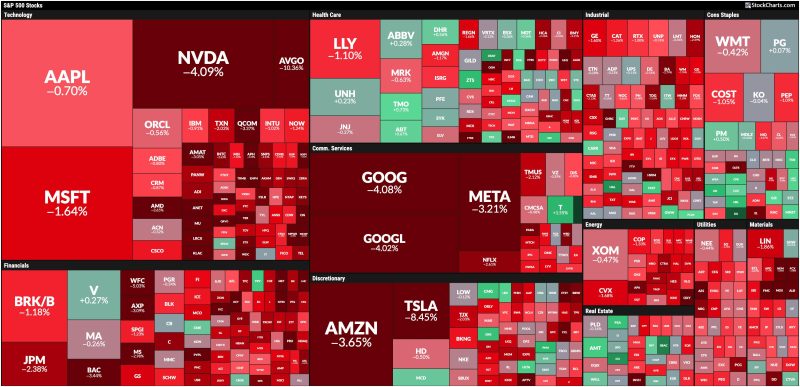

Broad-Based Stock Market Selloff: How to Position Your Portfolio

Understanding the current market landscape is crucial for successful investing. With the recent broad-based stock market selloff, many investors are left wondering about the best strategies to position their portfolios for future growth and protection against volatility. In this article, we will explore key considerations and actions you can take to navigate the turbulent market conditions.

Diversification remains a fundamental principle in managing a portfolio during times of uncertainty. By spreading your investments across various asset classes, industries, and geographic regions, you can reduce risk exposure and enhance the potential for long-term growth. Diversification helps cushion the impact of market downturns in any particular sector or asset class.

It is essential to review your portfolio allocation regularly and make adjustments based on changes in market conditions, economic outlook, and your financial goals. Rebalancing your portfolio involves selling assets that have outperformed and investing the proceeds in underperforming assets to maintain your target mix. This disciplined approach helps you stay on track with your investment objectives and reduce risks associated with market fluctuations.

When assessing your investment strategy in a market selloff, consider the quality of the companies in your portfolio. High-quality companies with solid fundamentals, strong competitive advantages, and sustainable growth potential are better positioned to weather market downturns and deliver long-term value to investors. Focus on investments with a track record of consistent performance, robust balance sheets, and healthy cash flows.

In times of market volatility, it is essential to remain disciplined and avoid making emotional decisions. Market downturns can trigger fear and uncertainty among investors, leading to impulsive actions that may harm your investment returns. Stay focused on your long-term investment goals, and maintain a diversified portfolio aligned with your risk tolerance and time horizon. Avoid trying to time the market or chase short-term gains, as this can expose you to unnecessary risks.

Consider incorporating defensive strategies into your portfolio to mitigate risk during market downturns. Defensive assets such as bonds, gold, and defensive stocks can provide stability and act as a hedge against equity market volatility. These assets tend to perform well during periods of market stress and can help protect your portfolio from significant losses.

Finally, seek opportunities in the market selloff to invest in high-quality assets at attractive valuations. Market downturns can create buying opportunities for long-term investors who are willing to take advantage of temporary mispricings in the market. Conduct thorough research and identify undervalued assets with strong growth potential to enhance the long-term performance of your portfolio.

In conclusion, navigating a broad-based stock market selloff requires a disciplined approach, sound investment principles, and a focus on long-term goals. By diversifying your portfolio, rebalancing regularly, investing in high-quality companies, remaining disciplined, incorporating defensive strategies, and seizing opportunities, you can position your portfolio for success in any market environment. Stay informed, stay focused, and stay invested for long-term wealth creation.