In today’s unpredictable economic landscape, investors are constantly seeking reliable indicators to assess the health of the financial markets. One interesting approach to evaluating market health is by examining the equities markets and their behavior. Equities, or stocks, represent ownership in a company and are a key component of many investors’ portfolios. By analyzing the activity and performance of equities, investors can gain valuable insights into the overall well-being of the markets.

One fundamental aspect of assessing market health through equities is analyzing market breadth. Market breadth refers to the number of individual stocks participating in a market advance or decline. A healthy market typically exhibits broad participation, with many individual stocks moving in sync with the overall market trend. On the other hand, a lack of market breadth, where only a small number of stocks are driving the market higher while the majority lag behind, can be a sign of potential weakness.

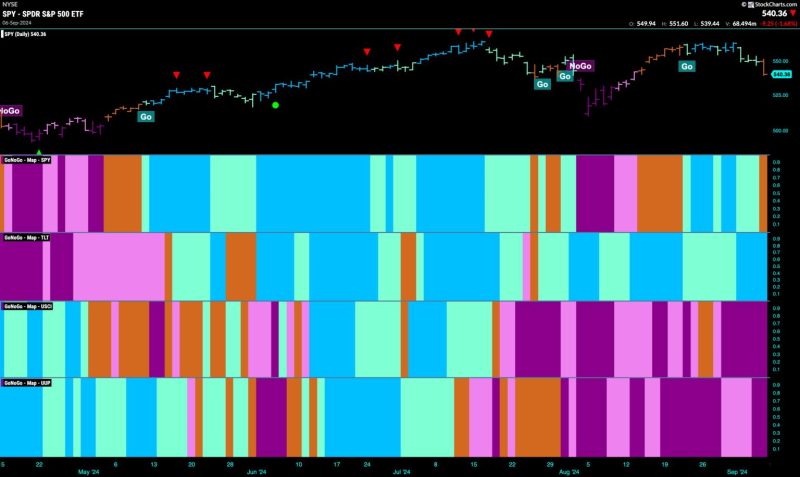

Another crucial factor in evaluating market health is the performance of key market indices. Major indices such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite are widely watched benchmarks that provide a snapshot of overall market performance. Observing these indices can offer valuable insights into market sentiment, investor confidence, and prevailing trends.

Analyzing market volatility is also essential in assessing market health through equities. Volatility measures the degree of price fluctuations in the markets and is often seen as a gauge of market risk. While some level of volatility is normal in financial markets, excessive volatility can indicate uncertainty and instability, potentially signaling underlying issues in the markets.

Furthermore, understanding market valuations is integral to evaluating market health. Valuation metrics such as price-to-earnings ratios, price-to-book ratios, and dividend yields can help investors gauge whether stocks are overvalued or undervalued relative to their fundamentals. Elevated valuations may suggest that stocks are priced beyond their intrinsic value, raising concerns about a potential market correction.

In addition to these broader indicators, investors can analyze sector performance to gain further insights into market health. Different sectors of the economy can perform differently based on various factors such as economic conditions, industry trends, and regulatory changes. By monitoring sector performance, investors can identify areas of strength or weakness within the markets and make informed investment decisions accordingly.

In conclusion, assessing market health through equities provides investors with a comprehensive view of the financial markets and helps them make informed decisions about their investments. By analyzing market breadth, key indices, volatility, valuations, and sector performance, investors can paint a more accurate picture of the current market environment and position themselves strategically for potential opportunities and risks. As always, it is crucial for investors to conduct thorough research and seek professional advice to navigate the complexities of the financial markets successfully.