Sector Rotation: A Strategy for Tactical Asset Allocation

Understanding sector rotation as a tactical asset allocation strategy is crucial for investors seeking to optimize their portfolio performance. Sector rotation involves shifting investments among different sectors of the economy based on anticipated performance drivers. This strategy aims to capitalize on market trends and economic cycles to maximize returns while managing risk. However, navigating the sector rotation dilemma requires a deep understanding of market dynamics and careful implementation.

One of the key challenges in sector rotation is predicting which sectors will outperform others over a specific time horizon. While historical trends and economic indicators can provide valuable insights, unforeseen events and market shocks can quickly change the dynamics. Therefore, investors need to stay informed about global economic developments, industry trends, and geopolitical risks to make informed sector allocation decisions.

Another dilemma faced by investors practicing sector rotation is the trade-off between diversification and concentration. Concentrating investments in a few sectors can lead to higher returns if those sectors outperform, but it also increases the risk of losses if they underperform. On the other hand, over-diversification can dilute the impact of strong sector performance on overall portfolio returns. Striking the right balance between concentration and diversification is essential for successful sector rotation.

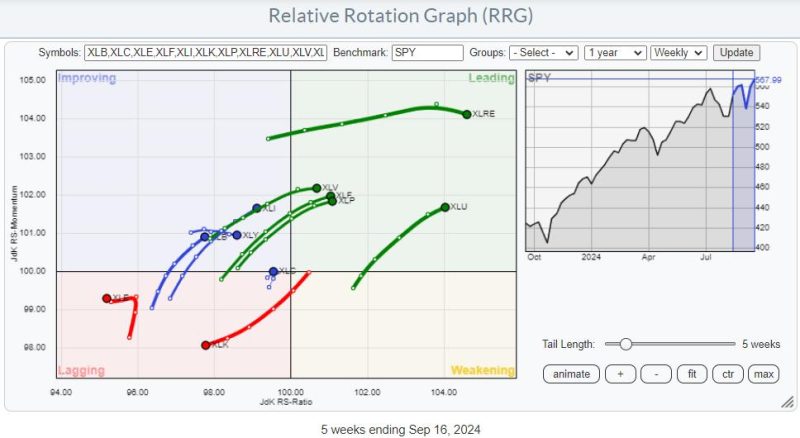

Implementing a sector rotation strategy requires active portfolio management and regular reassessment of sector performance drivers. Investors need to monitor key economic indicators, corporate earnings reports, and market sentiment to identify emerging sector trends. Additionally, utilizing technical analysis tools and quantitative models can help optimize entry and exit points for sector rotation decisions.

Incorporating sector rotation into an investment strategy can enhance portfolio returns and manage risk effectively. By dynamically allocating assets among sectors based on market conditions, investors can capitalize on opportunities for growth while mitigating potential losses during market downturns. However, sector rotation is not a one-size-fits-all strategy and requires continuous monitoring and adjustment to adapt to changing market dynamics.

In conclusion, sector rotation offers a proactive approach to tactical asset allocation, enabling investors to capitalize on sector-specific market trends and economic cycles. While facing challenges such as predicting sector outperformance and balancing concentration versus diversification, investors can benefit from the potential returns of this strategy with diligent research, active management, and disciplined execution. By understanding the nuances of sector rotation and its implementation, investors can navigate the sector rotation dilemma and unlock opportunities for optimizing their investment portfolios.