Exploring the Excess: Market Still Overvalued Despite Strong 2024 Q2 Earnings

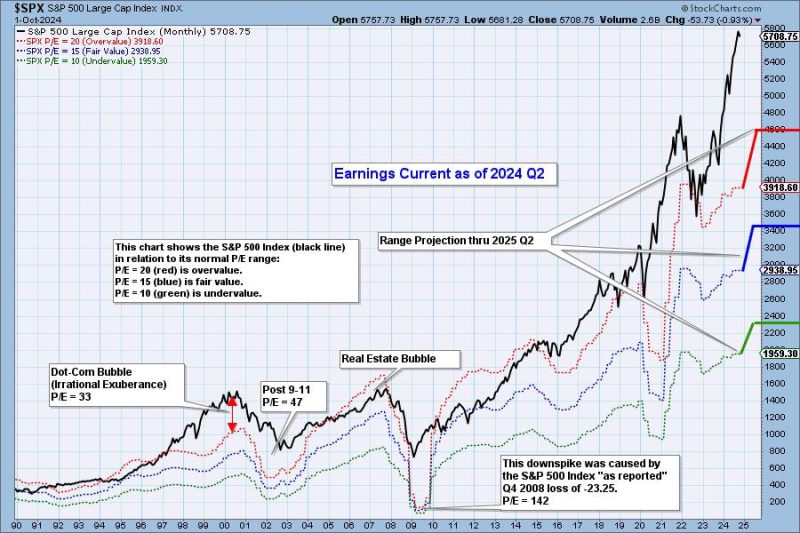

As reported on GodzillaNewz.com in a recent article discussing the second-quarter earnings of 2024, the market is currently viewed as being significantly overvalued. This assessment raises concerns among investors, with many believing that the market has reached unsustainable levels.

The article highlights several key indicators that point to the market being overvalued, including high price-to-earnings ratios, elevated levels of corporate debt, and signs of excessive speculation in certain sectors. These factors suggest that investors may be paying inflated prices for stocks that do not accurately reflect their underlying value.

In addition, the article points out that the Federal Reserve’s monetary policy, which has kept interest rates low for an extended period, has contributed to the overvaluation of the market. Low-interest rates have encouraged investors to take on more risk in search of higher returns, leading to inflated asset prices across the board.

Furthermore, the article touches on the potential risks of a market correction, citing the possibility of a sharp decline in prices as investors reassess their risk exposure. Such a correction could have widespread implications for the economy, potentially leading to a slowdown in consumer spending and business investment.

Overall, the article paints a cautionary picture of the current market environment, highlighting the need for investors to carefully evaluate their investment strategies and risk tolerance. By staying informed and remaining vigilant in the face of overvaluation, investors can better navigate the challenges and opportunities that lie ahead in the ever-evolving financial landscape.