In the world of finance, the concept of a secular bull market is a phenomenon that many investors closely monitor and analyze. A secular bull market is characterized by an upward trend in the financial markets that lasts for an extended period, typically spanning multiple years. This trend is driven by various factors such as economic growth, rising corporate earnings, and low interest rates. Understanding the dynamics of a secular bull market is crucial for investors looking to capitalize on long-term investment opportunities.

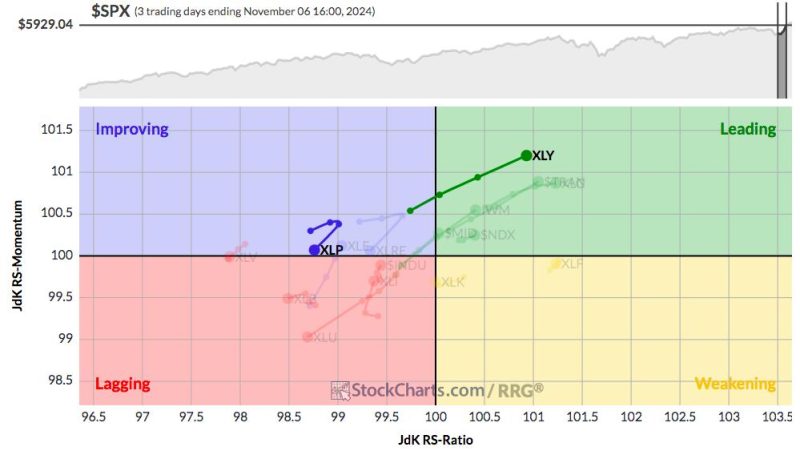

The current financial landscape shows that the secular bull market continues to march forward, albeit with a major rotation within different sectors. In recent times, we have witnessed a shift in market trends, with certain sectors outperforming others. This rotation is a natural part of the market cycle and presents both challenges and opportunities for investors.

One of the key drivers of the ongoing secular bull market is the accommodative monetary policies adopted by central banks around the world. In response to the global economic slowdown caused by the COVID-19 pandemic, central banks have implemented unprecedented stimulus measures to support financial markets and spur economic growth. These measures have helped sustain the upward momentum in the markets and have boosted investor confidence.

Moreover, the rollout of COVID-19 vaccines and the gradual reopening of economies have further bolstered investor sentiment, leading to a resurgence in economic activity. As a result, sectors that were previously battered by the pandemic, such as travel, hospitality, and energy, have started to recover, attracting investor interest.

However, as the market dynamics continue to evolve, investors need to be mindful of the changing landscape and adjust their investment strategies accordingly. The recent rotation within sectors highlights the importance of diversification and active portfolio management. Investors should consider rebalancing their portfolios to capitalize on emerging opportunities and mitigate risks associated with sector-specific downturns.

Technology and healthcare sectors have emerged as strong performers in the current market environment, driven by innovations, digital transformation, and increased healthcare spending. These sectors are likely to continue their growth trajectory in the coming years, presenting attractive investment prospects for investors seeking long-term returns.

In conclusion, the secular bull market persists with a major rotation in sectors, presenting a mixed bag of opportunities and challenges for investors. By staying informed about market trends, maintaining a diversified portfolio, and adapting investment strategies to changing dynamics, investors can navigate the secular bull market successfully and position themselves for sustainable long-term growth.