Riding the Equity Go Trend: Financials Fuel Surge in Price Strength

**Equity-Go Trend Sees Surge in Strength as Financials Drive Price Higher**

**Understanding Equity-Go Trend**

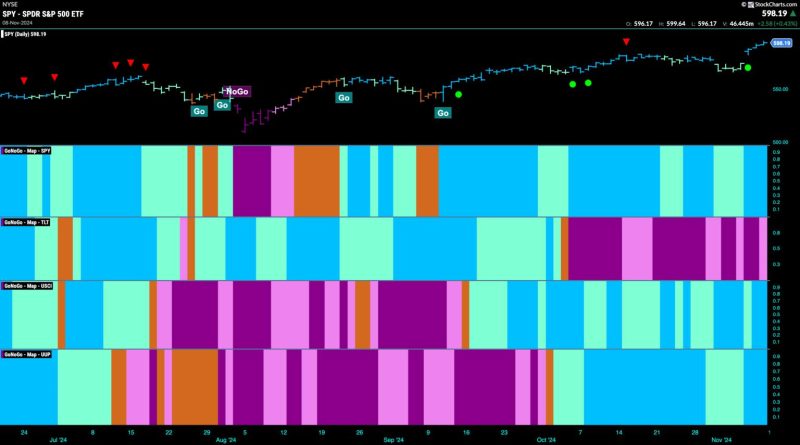

The Equity-Go trend has been on a significant surge lately, primarily driven by the strong performance of the financial sector. This trend indicates the overall movement and momentum of equities, reflecting the investor sentiment and the economic outlook.

**Financials Leading the Charge**

One of the key drivers behind the recent strength in the Equity-Go trend is the robust performance of financial companies. Banks, insurance companies, and other financial institutions have been reporting strong earnings, benefiting from a favorable economic environment and ongoing recovery efforts.

**Increased Investor Confidence**

The strong performance of financials has translated into increased investor confidence in the broader equity market. Investors are viewing these companies as solid investment opportunities, leading to higher demand and, subsequently, driving up stock prices.

**Market Dynamics at Play**

The Equity-Go trend is also influenced by broader market dynamics, such as interest rates, inflation expectations, and overall economic growth. As these factors continue to evolve, they impact investor behavior and the performance of equities across different sectors.

**Opportunities and Risks**

While the surge in the Equity-Go trend presents opportunities for investors to capitalize on the momentum, it also comes with risks. Rapid price movements and heightened volatility can expose investors to potential downside risks if market conditions suddenly change.

**Navigating the Trend**

Investors looking to navigate the Equity-Go trend should carefully analyze the underlying factors driving the trend and assess their risk tolerance. Diversification across sectors and asset classes can help mitigate risk and capitalize on opportunities presented by the trend.

**Conclusion**

The Equity-Go trend’s surge in strength, fueled by the financial sector’s performance, underscores the dynamic nature of equity markets and the importance of staying informed and agile as an investor. By understanding the market dynamics at play and embracing prudent risk management strategies, investors can navigate the trend effectively and make informed investment decisions.