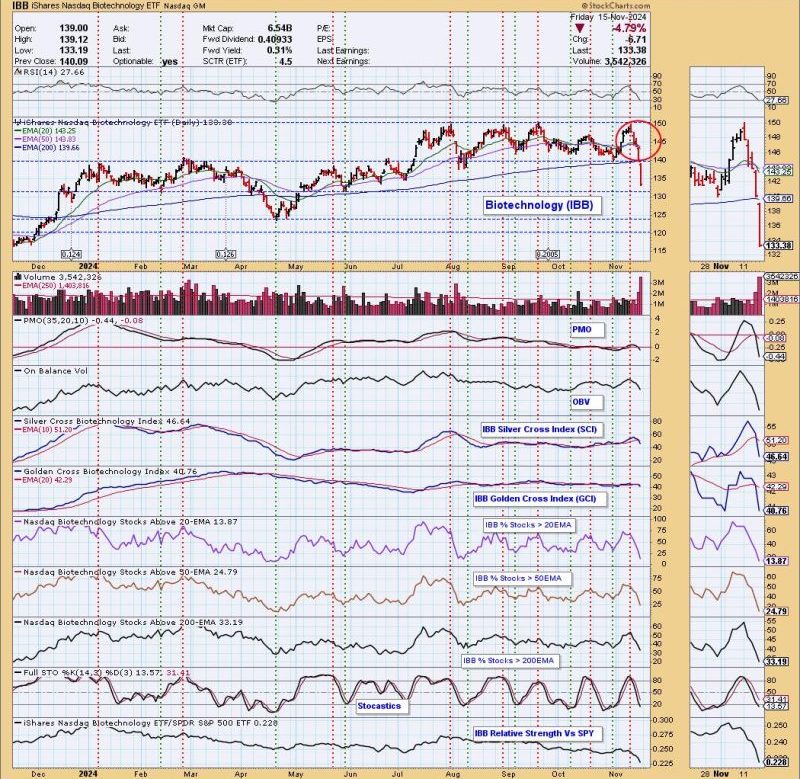

Biotech sectors have been rocked by significant market movements recently, as indicated by the emergence of the ‘dark cross’ neutral signal. This technical indicator, which occurs when a short-term moving average crosses below a long-term moving average, has raised concerns among investors and analysts alike. The implications of this signal extend beyond traditional market dynamics, shedding light on the underlying factors at play within the biotech industry.

One of the key reasons behind the emergence of the dark cross signal in the biotech sector is the wavering investor confidence in the industry. Biotech companies are often viewed as high-risk investments due to the volatile nature of the industry, with potential for significant gains offset by the inherent risks of developing new drugs and therapies. The dark cross signal serves as a stark reminder of these risks, prompting investors to reassess their positions in biotech stocks.

Another factor contributing to the dark cross signal is the broader market sentiment surrounding healthcare and pharmaceutical sectors. Regulatory changes, political pressures, and shifting consumer preferences all play a role in shaping the market landscape for biotech companies. As these external factors continue to evolve, biotechs must adapt and respond accordingly, or risk facing further market volatility.

Additionally, the dark cross signal underscores the importance of careful risk management and diversification in biotech investing. As with any high-risk industry, investors must be prepared for potential downturns and unexpected market movements. By spreading their investments across a range of biotech companies and maintaining a balanced portfolio, investors can mitigate the impact of negative signals such as the dark cross.

While the dark cross signal may be cause for concern among biotech investors, it also presents an opportunity for reflection and strategic planning. By closely monitoring market trends, staying informed about industry developments, and maintaining a diversified investment approach, investors can navigate the challenges posed by the dark cross signal and position themselves for future success in the dynamic biotech sector.