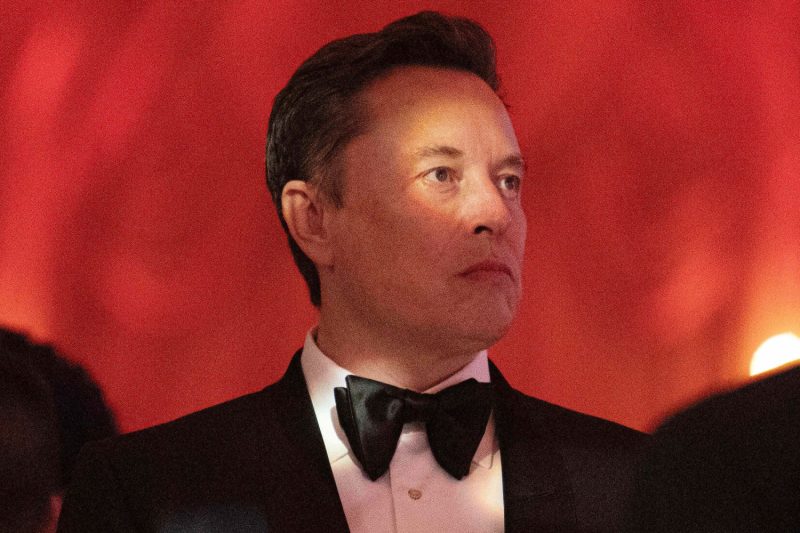

In a recent development that has captured global attention, Tesla CEO Elon Musk has encountered a setback in his bid to reinstate a $56 billion pay package. This contentious issue has sparked discussions and debates surrounding executive compensation and corporate governance practices.

The legal dispute stemmed from a shareholder lawsuit challenging the massive compensation package that was approved by Tesla’s board of directors back in 2018. The package was designed to reward Musk for achieving certain performance milestones, including increasing Tesla’s market capitalization to a staggering $650 billion.

Despite the ambitious goals set forth in the pay package, the lawsuit alleged that the Tesla board had failed in its fiduciary duty by approving such an exorbitant award for Musk. The shareholder plaintiffs argued that the package was unjustifiable and would unduly enrich Musk at the expense of Tesla’s investors.

In response to the lawsuit, a Delaware judge recently ruled against Musk, upholding a previous decision that deemed the pay package invalid due to procedural flaws in its approval process. This ruling represents a significant blow to Musk’s attempt to secure one of the largest executive compensation packages in history.

The judge’s decision raises important questions about the oversight and accountability of corporate boards in determining executive compensation. While it is common for companies to offer performance-based incentives to their leaders, the size and structure of Musk’s proposed pay package raised eyebrows and fueled concerns about governance practices at Tesla.

The outcome of this legal battle could have broader implications for how companies design and approve executive compensation packages in the future. Shareholders and corporate governance experts may scrutinize such arrangements more closely to ensure that they are aligned with the best interests of the company and its stakeholders.

Additionally, Musk’s failed bid to reinstate the $56 billion pay package underscores the balancing act that companies must navigate in rewarding their top executives while also demonstrating good governance and accountability. As one of the most prominent and controversial figures in the business world, Musk’s compensation practices have often come under scrutiny, highlighting the ongoing debate over the appropriate levels of executive pay.

As Tesla continues to navigate these complex issues surrounding executive compensation and governance, shareholders and industry observers will be closely monitoring how the company addresses these challenges moving forward. The outcome of this legal battle may serve as a cautionary tale for other companies grappling with similar issues, emphasizing the importance of transparency, oversight, and accountability in executive compensation decisions.