Market Sentiment Indicators: Unveiling the Bearish Phase

Market sentiment plays a crucial role in guiding investors and traders in their decision-making process. The ability to gauge the prevailing sentiment can provide valuable insights into market dynamics and potential trends. In this article, we explore three key market sentiment indicators that have confirmed the current bearish phase in the market.

The Fear and Greed Index is a popular sentiment indicator that measures the level of fear and greed among investors. The index ranges from 0 to 100, with extreme fear typically indicating buying opportunities and extreme greed signaling potential market tops. In the current scenario, the Fear and Greed Index has dipped below 20, reflecting heightened fear and pessimism among market participants. This suggests a bearish outlook in the near term, as investors remain cautious and risk-averse.

The Put/Call Ratio is another important sentiment indicator that helps assess the sentiment of options traders. A high Put/Call Ratio indicates a bearish sentiment, as traders are buying more put options (which profit from a decline in prices) relative to call options (which profit from an increase in prices). In recent weeks, the Put/Call Ratio has surged, reaching levels not seen in months. This spike in bearish sentiment indicates a growing pessimism among options traders, signaling a potential downturn in the market.

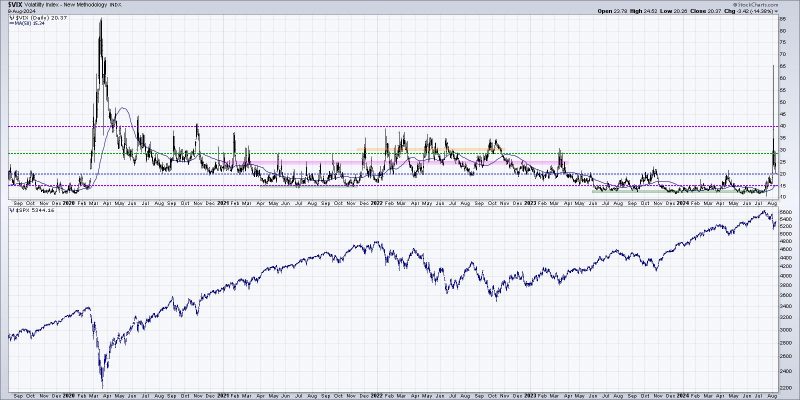

The VIX, also known as the fear index, measures market volatility and investor expectations for future price fluctuations. A high VIX level indicates increased volatility and uncertainty, often associated with bearish market conditions. In recent days, the VIX has spiked sharply, reaching multi-month highs as concerns over inflation, interest rates, and geopolitical tensions weigh on market sentiment. This surge in volatility suggests that investors are bracing for a rocky road ahead, as market conditions remain turbulent and unpredictable.

In conclusion, the combination of these three market sentiment indicators paints a grim picture of the current market environment. Heightened fear and pessimism, along with rising Put/Call Ratios and surging volatility levels, all point towards a bearish phase in the market. Investors and traders would be wise to exercise caution and carefully monitor these indicators for further clues on market direction. As always, it is crucial to stay informed, stay disciplined, and stay prepared for any eventualities in the ever-changing landscape of the financial markets.