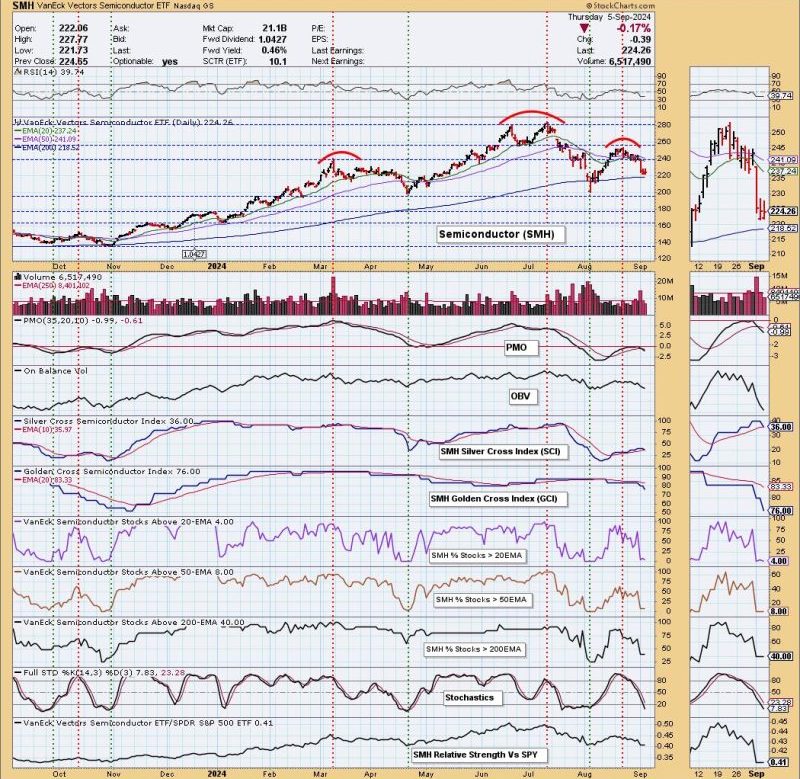

Unveiling the Bearish Trend: Intermediate-Term Head & Shoulders Signal for Semiconductors (SMH)

The semiconductor industry has been closely monitored by investors and analysts due to its significant impact on various sectors, including technology, automotive, and healthcare. Recently, the semiconductor sector has been displaying an intermediate-term bearish head and shoulders pattern, specifically on the SMH ETF, which tracks the performance of major semiconductor companies.

The head and shoulders pattern is a technical analysis formation that typically indicates a potential trend reversal. In this case, the SMH ETF has formed a pattern that consists of three peaks – two shoulders and a head. The left shoulder formed in early 2021, followed by a higher head in the spring, and concluded with the right shoulder in the summer. The neckline, which connects the lows of the pattern, acts as a key level to watch for potential confirmation of the bearish trend.

The breakdown below the neckline of the head and shoulders pattern on the SMH ETF suggests a shift in trend from bullish to bearish. This breakdown typically triggers sell signals for traders and investors who follow technical analysis. The length of the pattern from the head to the neckline can be used to estimate the potential downside target for the ETF.

Furthermore, other technical indicators such as moving averages, relative strength index (RSI), and volume analysis can provide additional confirmation of the bearish outlook for the semiconductor sector. A convergence of indicators pointing towards a bearish trend strengthens the likelihood of a sustained downside move in the SMH ETF and semiconductor stocks.

Additionally, external factors such as global economic conditions, supply chain disruptions, and geopolitical tensions can also impact the semiconductor industry’s performance. Investors should consider the broader market environment and sector-specific news when interpreting technical patterns like the head and shoulders formation.

In conclusion, the intermediate-term bearish head and shoulders pattern on the SMH ETF serves as a warning sign for investors to exercise caution in the semiconductor sector. While technical analysis provides valuable insights, it is essential to incorporate fundamental analysis and market dynamics to make informed investment decisions. Monitoring key support levels and staying informed about industry developments can help investors navigate potential downturns in the semiconductor sector effectively.