In the world of investing, keeping a sharp eye on market movements can be instrumental in making informed decisions. The week ahead provides an opportunity to reassess your investment strategy and align it with the prevailing market dynamics. To assist in this process, one crucial indicator to watch is the Nifty index. As we delve into the details of upcoming market movements, it’s essential to analyze the Nifty from a critical perspective.

***Understanding the Nifty***

The Nifty, also known as the NSE Nifty 50 index, is a key stock market index in India. Comprising 50 major Indian companies across various sectors, the Nifty provides a comprehensive overview of the performance of the Indian equity market. Tracking the Nifty can offer valuable insights into market trends, sentiment, and potential opportunities.

***Key Factors Influencing the Nifty***

Several factors can significantly impact the movement of the Nifty index:

– **Global Economic Conditions**: The Nifty is influenced by global economic trends, geopolitical events, and international market performance. Changes in global economic conditions can lead to volatility in the Nifty.

– **Domestic Economic Indicators**: Economic indicators such as GDP growth, inflation rates, and industrial production play a crucial role in shaping the Nifty’s trajectory. Positive economic data can drive the Nifty higher, while negative data can lead to downturns.

– **Corporate Earnings**: The financial performance of Nifty 50 constituents can have a direct impact on the index. Strong corporate earnings typically boost investor confidence and drive the Nifty upwards.

– **Market Sentiment**: Investor sentiment, market speculation, and macroeconomic developments can influence the Nifty’s movement. Positive sentiment tends to drive the index higher, while negative sentiment can trigger sell-offs.

***Technical Analysis of the Nifty***

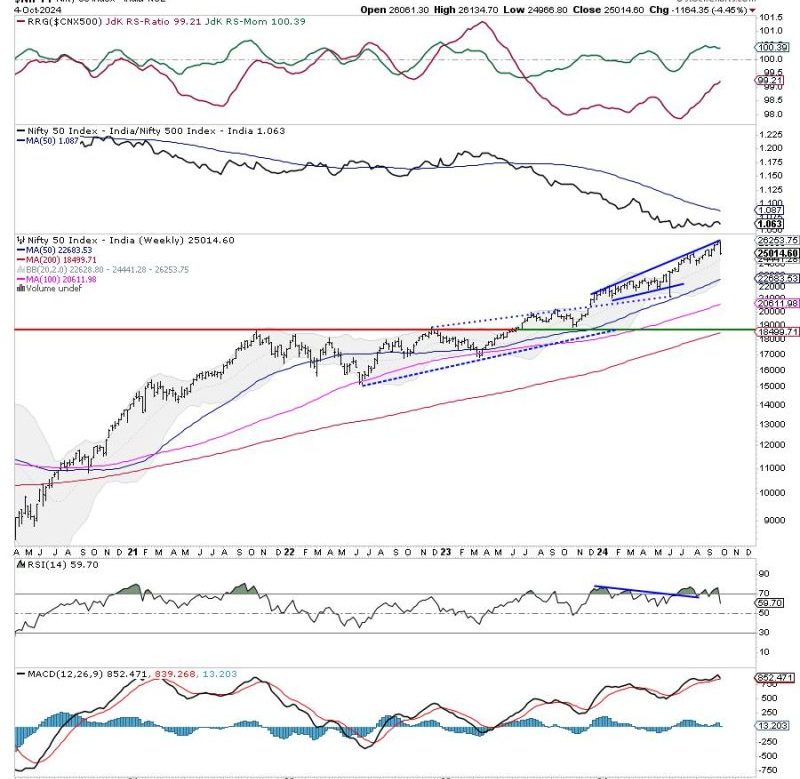

Technical analysis involves studying historical price data and market statistics to forecast future price movements. When applying technical analysis to the Nifty, analysts use various tools and indicators to identify trends, support and resistance levels, and potential entry and exit points.

Chart patterns, moving averages, Relative Strength Index (RSI), and other technical indicators can help investors make informed decisions based on price action and market momentum. By analyzing these factors, traders can gain a deeper understanding of the Nifty’s current position and potential future movements.

***Conclusion***

As you gear up for the week ahead, remember to pay close attention to the Nifty and its underlying factors. By analyzing the Nifty from a critical perspective and incorporating technical analysis, you can better position yourself to navigate the market with confidence and precision. Stay informed, stay vigilant, and capitalize on opportunities that align with your investment objectives.