Buckle Up: Markets Brace for News-Heavy Week with Short-Term Bearish Signal

In the world of finance, market signals play a crucial role in guiding investors’ decisions. While there are various indicators and signals that investors rely on to gauge market sentiment, one such signal that has recently caught the attention of many traders is the short-term bearish signal observed as markets brace for a news-heavy week.

Understanding the significance of this bearish signal requires a deep dive into the factors contributing to its emergence. As the markets anticipate a week filled with significant news events, including economic data releases, corporate earnings announcements, and geopolitical developments, investors are on edge, trying to assess how these events could impact asset prices.

The term bearish signal denotes a sentiment or situation where investors are pessimistic about the direction of the market or a particular asset. In this case, the short-term bearish signal suggests that traders are cautious and expect a temporary downward trend in prices. This sentiment can be driven by a variety of factors, such as uncertainty surrounding key events, fear of unexpected outcomes, or negative market dynamics.

One key aspect to consider is the potential market reaction to news events. Economic data releases, like inflation reports or unemployment figures, can have a significant impact on market sentiment and shape investors’ expectations about future interest rate decisions by central banks. Similarly, corporate earnings announcements can lead to sharp movements in stock prices, especially if companies miss or exceed analysts’ expectations.

Additionally, geopolitical developments, such as trade tensions or diplomatic disputes, can introduce volatility into the markets and increase risk aversion among investors. The uncertainty surrounding these events can trigger a flight to safe-haven assets and drive down riskier investments.

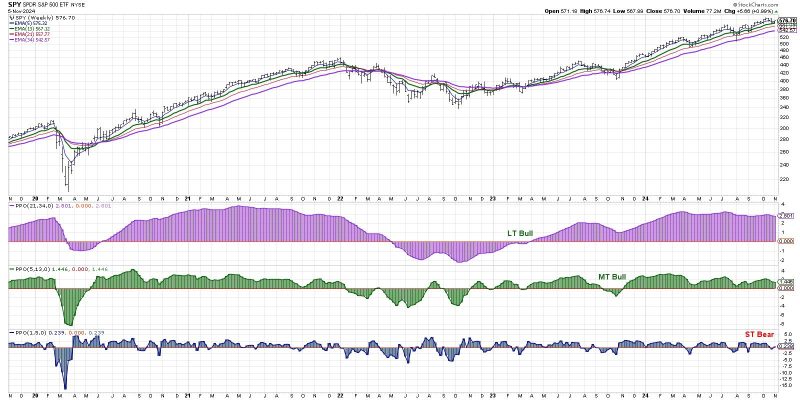

Another factor contributing to the short-term bearish signal is the technical analysis of market trends and patterns. Traders often use technical indicators, such as moving averages or chart patterns, to identify potential turning points in asset prices. When these indicators point to a bearish outlook, it can reinforce investors’ cautious stance and lead to selling pressure in the market.

It is essential for investors to exercise caution and adopt risk management strategies during periods of heightened uncertainty and bearish signals. Diversification of investment portfolios, setting stop-loss orders, and staying informed about market developments are some ways to navigate volatile market conditions and protect against potential downside risks.

In conclusion, the emergence of a short-term bearish signal as markets brace for a news-heavy week underscores the importance of monitoring market sentiment, news events, and technical indicators in making informed investment decisions. By staying vigilant and adapting to changing market conditions, investors can position themselves to navigate turbulent times and seize opportunities that arise amidst uncertainty.