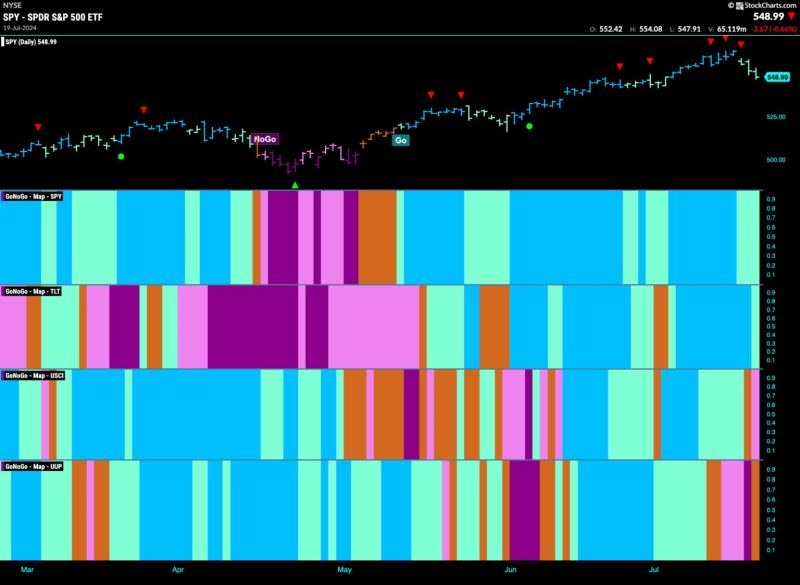

The recent shift in financial markets has signaled a change in investment trends, as equity markets appear to be weakening while financials are showing signs of outperformance. This shift reflects a broader reevaluation of market dynamics and investor sentiment, with implications for strategic investment decisions.

**Understanding Market Trends**

Equity markets have long been viewed as the cornerstone of investment portfolios, with stocks representing ownership in companies and offering the potential for high returns. In recent years, the rise of index funds and passive investing has driven significant flows into equity markets, leading to elevated valuations and heightened volatility. However, the recent weakening of equity markets suggests a potential shift in investor preferences and risk appetite.

Financials, on the other hand, encompass a broad range of assets including bonds, currencies, and commodities. These instruments are often considered safer and less volatile than equities, offering diversification benefits and capital preservation. The outperformance of financials in the current market environment may indicate a flight to safety among investors seeking more stable returns.

**Impact on Investment Strategies**

For investors, the changing market dynamics present both challenges and opportunities. Those heavily invested in equities may need to reevaluate their portfolios and consider reallocating assets to financial instruments that offer greater stability and downside protection. Diversification across asset classes, including financials, can help mitigate risk and preserve capital in volatile market conditions.

At the same time, investors looking to capitalize on the outperformance of financials may consider shifting their focus towards these assets. Opportunities exist in fixed income securities, currencies, and commodities that offer attractive risk-adjusted returns and diversification benefits. By staying attuned to market trends and adjusting investment strategies accordingly, investors can position themselves for long-term success in a dynamic environment.

**Future Outlook**

As the financials sector continues to outperform equities, the broader market is likely to undergo further adjustments in response to changing investor preferences. Economic factors, geopolitical events, and central bank policies will all play a role in shaping market dynamics in the months ahead. Investors should remain vigilant and adaptable, ready to pivot their strategies as new opportunities emerge and risks evolve.

In conclusion, the recent shift in market trends towards financials outperforming equities underscores the importance of flexibility and diversification in investment strategies. By understanding the implications of these trends and adapting proactively, investors can navigate volatile markets and position themselves for long-term success.